You may have seen my other post on the AusIMM International Uranium Mining Conference in Perth 2014. I had the opportunity to attend, I have to admit I did not know a great deal about the industry and had my preconceptions before I attended but tried to go with an open mind. Needless to say there were protestors at the door to welcome me on the first day. If there ever was a subject outside of religion which would enrage unite people then Nuclear energy is it.

As it stands, the uranium market is still a young one whose “laws” have yet to become entirely clear. This tends to disorient observers and decision-makers who are anxious to predict its development. It has a number of characteristics which are sharply differentiated from those of other minerals, including other energy commodities. The commodity has only really been in use for 50 years and has had a couple of issues during that time. Many environmental groups are united against its use. So why are ethical funds investing in the commodity and its industry

As it stands, the uranium market is still a young one whose “laws” have yet to become entirely clear. This tends to disorient observers and decision-makers who are anxious to predict its development. It has a number of characteristics which are sharply differentiated from those of other minerals, including other energy commodities. The commodity has only really been in use for 50 years and has had a couple of issues during that time. Many environmental groups are united against its use. So why are ethical funds investing in the commodity and its industry

A recent Corporate Watch Australia survey reveals that many so-called ethical investment funds invest in uranium mining. Ethical investment itself is booming: from its origins in 1984 with a fund nicknamed ‘Brazil’, because you’d have to be nuts to invest in it, the sector is now worth $2 trillion worldwide. According to the Responsible Investment Association of Australasia, Australian responsible investment portfolios grew from $4.5 billion to $17.1 billion from 2004 to 2007.

Many ethical investment funds use an approach known as ‘best of sector’. This means they do not rule out investing in any legal industry, but instead seek investment in companies that claim to be trying to improve their ethical practices. A sector cannot be ruled out on the grounds that it is simply wrong – if a company can show that it is making some gesture, however tokenistic, to improve its practices, it can be included in an ethical portfolio.

In the words of Yvonne Margarula, Mirarr senior traditional owner in the Northern Territory: “Uranium mining has … taken our country away from us and destroyed it … Mining and the millions of dollars in royalties have not improved our quality of life.” This is a common cry about any form of mining or resources think FMG and the Solomon hub or Tom Price. However, we still fly/drive/cycle and continue to buy the new phones as they hit the market. So how can this be balanced.

I think the stand out “take away” for me was the environmental slant on the discussion. This need for balance came through loud and clear. I have to credit Ben Heard of Think Climate Consulting for this bit of information. Not only does your Iphone require charging daily, it also remains connected to the internet through communication towers and internet substations/routers. The total consumption of your Iphone is around that of a common household fridge. So in short that is a lot of energy required to run your home right now along with your phone or the internet your computer is connected to. The next concept from that is the requirements of a emerging economy. What do they want when they get some spare cash? What is the main device for the majority of internet traffic in Bangladesh?

Pollutants from burning fossil fuels can create health hazards (illness and death). The most common of such emissions from electricity generation are small particulates sulphur dioxide (SO2) and nitrogen oxides (NOX). For an example of this think about Beijing.

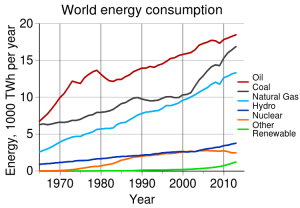

What are our other power alternatives? Besides nuclear power the one providing 5.7% of total global energy demand right now. I challenge you to find a alternative which has the capability to replace coal or gas. I’m still looking, and yes the jury is out but I haven’t found one yet. Just imagine how much simpler and more optimised Australia would be, with plunging greenhouse gas emissions and better protection for all of us from escalating power prices if:

- Nuclear power was considered a “viable thermal power alternative” in Government modelling

- The assumed emissions intensity limit for new plant was 0t CO2-e because climate change is actually urgent, it demands an urgent response, nuclear can deliver exactly that service and any new plant other than zero-carbon plant, with all we know in 2012 and beyond, is virtual insanity

If I could send you to a couple of links:

Now Pandoras Promise gave a clear argument. In that America is aimed at an “energy cliff” with economic threats worse than the Great Recession, says Danny Roderick, CEO of Westinghouse. We can’t avoid that, he says, without a readily available supply of clean energy. The film “Pandora’s Promise,” “correctly suggests that nuclear power is the safest, most stable and most secure option for achieving that goal.”

Nuclear is clearly not perfect. I need to take some more time to look into the whole economical and environmental impacts. But just for a second open your mind to the idea that there is a better solution out there, however not complete it could change things over night if it was adopted.

I have not made up my mind but I understand we can not except the need for energy and development. I can not cover the whole topic here in one post. However, I have tried to touch on some common issues, others I have missed altogether. So I am emphasising the conversation; I am happy to hear from all new comers to nuclear power. Challenge your thought and mine. Tell me what you thought of the post and the videos, and what else you would like to know.

For extended analysis head to http://www.complexityandchaos.com

Mine planning and mine analysis tips please head to http://www.mineplanningtoday.com

For discounted gopro, tips on how to get the cheapest, product comparisons, and travel accessories head to http://www.buyacheapgopro.com

No comments:

Post a Comment

Hi, Thanks for your comment, if you like the blog please take the time to share it with your friends. Josh